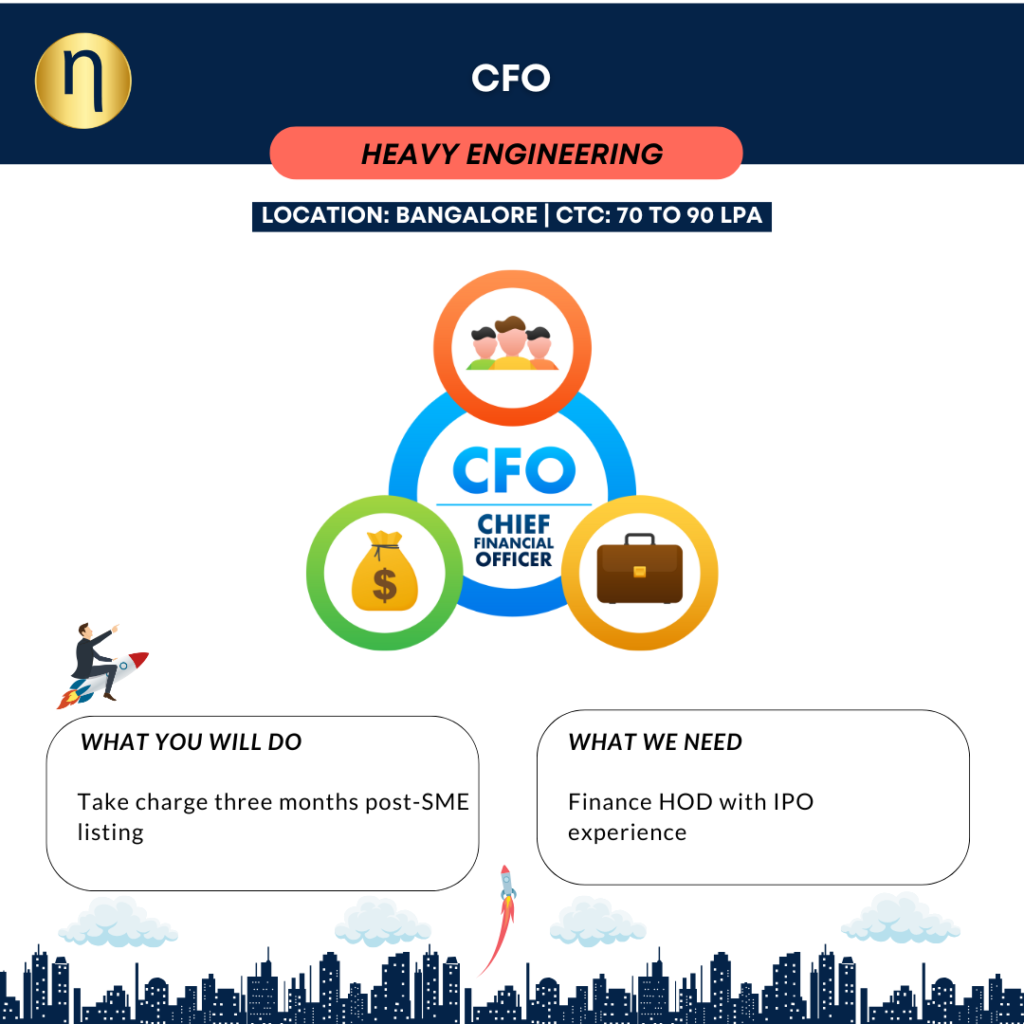

Job Summary

Seeking a CFO. The company has successfully listed on the SME exchange. The CFO will take charge three months post-listing and lead the organisation across the next critical juncture—from SME-listed entity to Main Board IPO, from organic growth to strategic scaling, and from compliance-led reporting to institutional-grade governance and capital markets readiness.

Job Profile:

A. Financial Engineering & Value Creation

Capital structure optimisation: blended capital, lowest cost of funds, equity/quasi equity structuring

Project & contract financial engineering: milestone-backed financing, securitisation, BG packages

Monetisation & cash unlocking: asset-light models, advance-backed procurement, inventory financing

Investor value maximisation: EBITDA uplift, ARR valuation for NOVA, multi-SBU reporting

B. Strategic Finance & Growth Acceleration

Build and execute the investment case for Main Board IPO transition

Identify high-ROCE growth levers across EPC, manufacturing, signalling and safety systems

Evaluate M&A;, JV, and strategic partnerships

Create capital-based entry barriers for long-term competitiveness

C. Pricing, Profitability & Commercial Strategy

Dynamic pricing engines for tenders

Profitability simulations and multi-scenario modelling

Lifecycle costing and unit economics for products and EPC

Contracting frameworks for LD mitigation and cash protection

D. FP&A; Architecture for a High-Growth Enterprise

Realntime financial architecture integrated with ERP

Rolling forecasting, business scorecards, segment P&Ls;

Predictive analytics for overruns and receivable bottlenecks

3. Core Responsibilities (Enhanced)

Lead financial strategy for 3–5x scale-up over the next 4 years as a listed company

Strengthen post-IPO governance, investor relations, disclosures, and compliance frameworks

Oversee commercial deal structuring, pricing strategy, and contract risk

Drive treasury innovation and capital structure optimisation

Strengthen compliance, audit, and risk management systems

Lead financial digital transformation including ERP/MIS upgrades

Requirements:

Education:

CA mandatory

CFA / MBA-Finance preferred

Additional certifications in corporate finance, valuation, or treasury desirable

Experience:

18–25 years of senior finance leadership experience

Exposure to capital markets, IPO environments, and investor relations

Strong background in EPC, infrastructure, manufacturing, rail/metro, or process industries

Proven track record in financial engineering and value creation

Leadership Style:

Strategic, analytical, forward-looking

Strong board-management presence

Ability to drive scalable financial systems

Governance-first mindset with high integrity

Wishing you all the best in your job search! Connect with Netsyscon Consulting socially Instagram ~ Linkedin ~ YouTube